Call For A Consultation

(703) 492-9955

Serving clients in:

Prince William County

Fairfax County

Stafford County

Loudoun County

Fauquier County

Call For A Consultation

Prince William County

Fairfax County

Stafford County

Loudoun County

Fauquier County

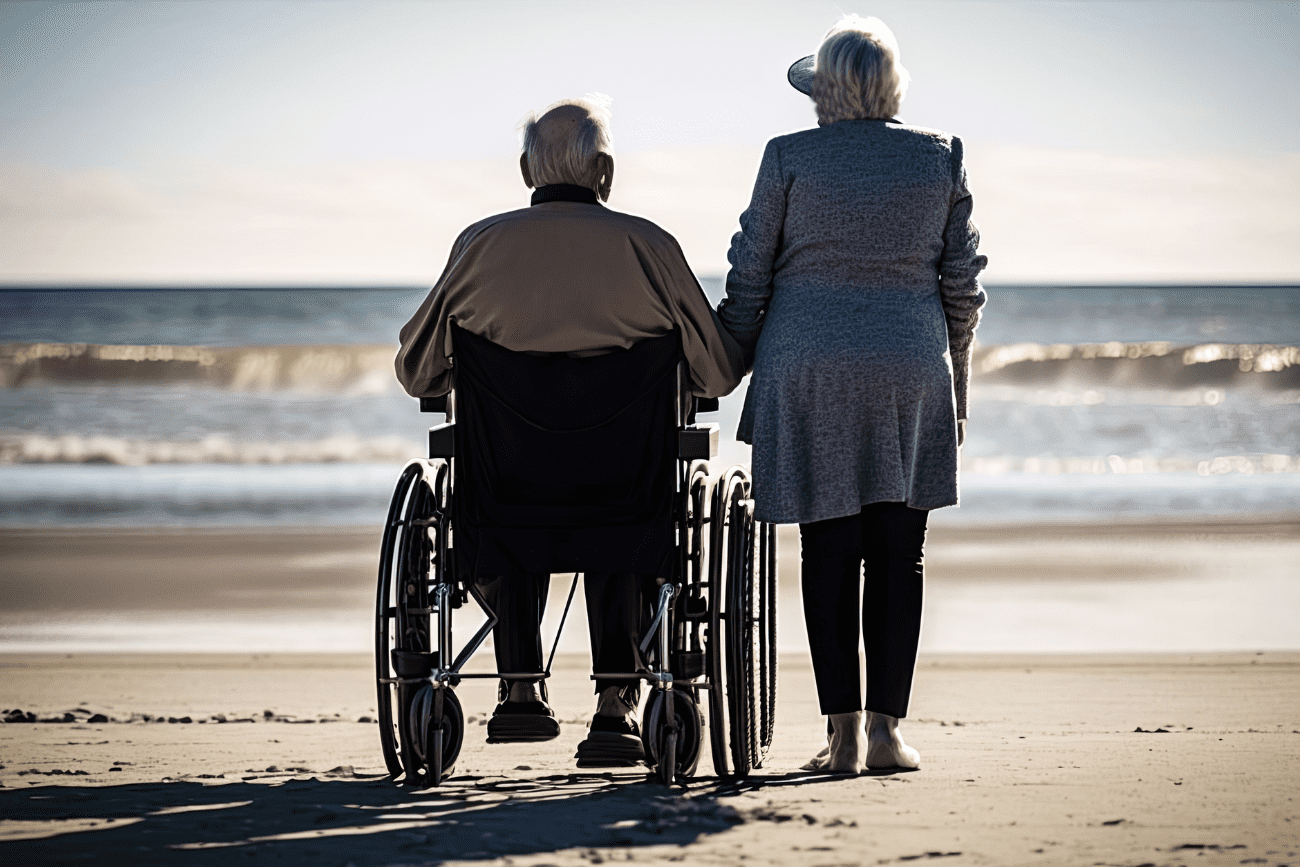

Caring for a veteran can be both an honor and a challenge. As their health declines, understanding the benefits available to them through the Veterans Administration (VA) is essential. The VA offers two distinct pension benefits that can help support veterans who need extra care—the Aid and Attendance pension benefit and the Housebound benefit. Let’s take a closer look at each one so you can make sure your veteran receives all of the assistance they are entitled to.

Aid and Attendance Pension Benefit

The Aid and Attendance pension benefit is available to veterans who require help with daily tasks such as bathing, eating, dressing, or other activities of daily living. A veteran must have served during wartime, be 65 years or older, or be totally disabled regardless of age in order to qualify for this pension benefit. Additionally, their net worth must not exceed certain limits set by the VA which vary depending on whether or not there is a dependent involved.

In order to receive this pension benefit, a qualified veteran must submit evidence of their disability including medical records and/or doctor’s notes that attest to their need for Aid and Attendance due to physical disability or mental impairment; financial documentation such as tax returns; proof of service; and proof of age. Once approved, they can receive up to $2,229 per month if they are single and up to $3,536 per month if they have a spouse or dependent(s). If the veteran does not initially qualify, legal planning may be done with the help of a Woodbridge elder law attorney to reallocate assets and income in order to fall within the VA’s guidelines.

Housebound Benefits

Housebound Benefits are available only if a veteran has been declared permanently housebound by the VA due to disability. The requirements for receiving this benefit include having served during wartime, being rated permanently housebound by the VA due to disability (including age-related disabilities), having limited income (under certain financial limits set by the VA), and having a net worth below certain limits set by the VA. In addition to those requirements, veterans must also submit evidence of their disability including medical records from doctors or other healthcare providers; financial documents such as tax returns; proof of service; proof of age; and any applicable documents from Social Security showing permanent housebound status.

Getting Help

Navigating elder law issues can be difficult when it comes to managing a veteran’s caregiving needs. However, being aware of all benefits available through the Veterans Administration is essential for caregivers to provide optimal care within their budget constraints. Our Woodbridge elder law attorneys are here to help veterans and their loved ones learn which benefits may apply in specific cases (and if any legal planning is necessary to qualify) so that the family receives all of the assistance they are entitled to under federal law. To schedule a consultation, simply call our office at 708-492-9955.

David Wilks has practiced law in Northern Virginia and

Prince William County for more than thirty years as

a tax lawyer by training and education. Read More